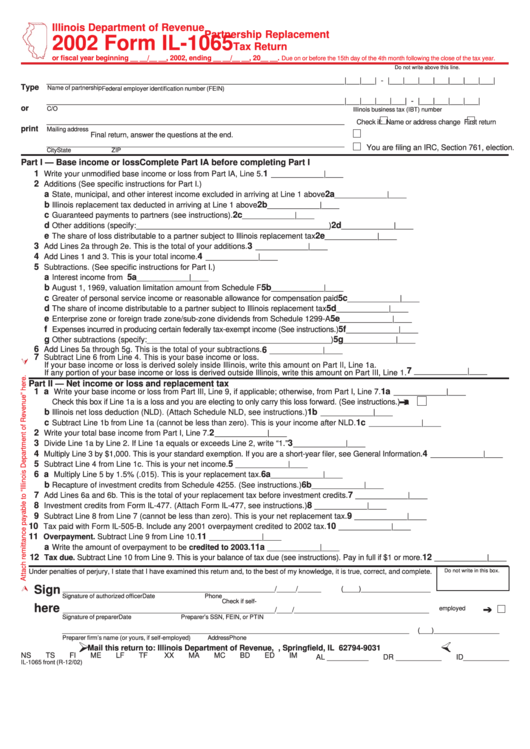

The incomplete return penalty will be assessed unless the return is more than 12 months late.įor returns due between 1/1/21 and 12/31/22, the penalty is $210. If the return is both incomplete and late, only one penalty will be assessed. The penalty can also be assessed if the return is filed without all the necessary information (unless there is reasonable cause). Return of Partnership Income, by the due date, including extension (IRC §6698). The PenaltyĪ late filing penalty is assessed against the partnership if the partnership fails to file Form 1065, U.S. We’ve talked quite a bit about individual penalty abatement in the past, so we thought we’d come at it from a slightly different angle in this blog post: how to abate the penalty for failing to file Form 1065, U.S. Penalty abatement cases are often very straightforward and still extremely valuable to clients. Luckily, not all tax resolution is as complicated as a doubt as to liability Offer in Compromise or Trust Fund Recovery Penalty case. There are a lot of compelling reasons to offer tax resolution services, but tax resolution can also get complicated, and that scares away a lot of tax professionals.

0 kommentar(er)

0 kommentar(er)